Before buying a warranty protection plan, understand your product's unique needs based on its type and care. Thoroughly compare terms, coverage, and exclusions among plans, balancing cost and benefit to find tailored protection that aligns with your investment's risks and value.

When purchasing a new gadget or appliance, choosing the right warranty protection plan is essential to safeguard your investment. This guide will help you navigate the process effectively. First, understand what coverage your product requires based on its nature and usage. Next, compare plan terms and conditions closely, paying attention to exclusions and limitations. Finally, assess the cost-benefit ratio of each plan to find the best balance between protection and affordability.

- Understand Your Product's Coverage Needs

- Compare Plan Terms and Conditions Thoroughly

- Assess Cost vs. Benefits of Each Plan

Understand Your Product's Coverage Needs

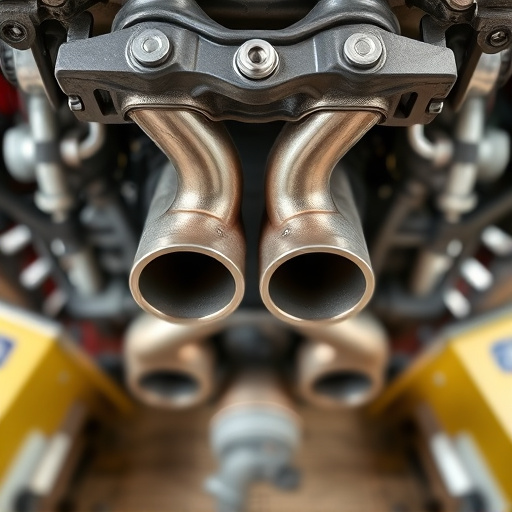

Before diving into comparing different warranty protection plans, it’s crucial to comprehend the specific coverage needs of your product. Not all items require the same level of safeguard. For instance, electronics might necessitate extended warranties due to their rapid technological advancements and potential vulnerabilities to technical glitches. Conversely, automotive vehicles demand comprehensive plans that cater to both mechanical breakdowns and aesthetic issues like scratch protection and high-quality finishes. Understanding these nuances ensures you select a plan that aligns with your product’s unique risks and requirements.

Moreover, considering the care and maintenance practices involved in your product’s lifecycle is essential. In the realm of automotive detailing, for example, some warranties may not cover damage from neglect or improper upkeep. Thus, evaluating both the inherent characteristics of the item and your personal responsibilities in maintaining it is vital to making an informed decision when choosing a warranty protection plan.

Compare Plan Terms and Conditions Thoroughly

When comparing warranty protection plans for various services or products, it’s essential to delve into the intricate details and thoroughly examine the terms and conditions. Every plan has its unique stipulations, coverage limits, and exclusions. For instance, when considering a warranty for vehicle window tinting or professional PPF (Paint Protection Film) installation, ensure you understand the duration of the warranty, what is covered, and any specific requirements for claims. Some plans may only cater to manufacturing defects while others could include damage from accidents or natural elements.

Pay close attention to exclusions, such as pre-existing conditions or instances where the warranty doesn’t apply due to misuse or inadequate maintenance. Also, check if the plan offers additional perks like free roadside assistance or discount programs for future services, which can enhance the overall value of the warranty protection. Remember, understanding these terms will empower you to make an informed decision and choose a plan that aligns best with your needs, ensuring peace of mind and high-quality finishes on your investments, whether it’s a vehicle or any other asset.

Assess Cost vs. Benefits of Each Plan

When comparing warranty protection plans, understanding the cost-benefit ratio is paramount. Every plan comes with its price, but the value it offers can vary significantly. Evaluate each option by scrutinizing the coverage extent and the associated expenses. A comprehensive plan might include protections for various vehicle components, such as engine, transmission, and cosmetic damages, along with roadside assistance benefits. However, these plans often come at a higher cost compared to basic coverage options that may only protect against major failures. Weighing the potential repair costs against the plan’s price is crucial in making an informed decision.

Consider the specific needs of your vehicle, especially if you own a high-value asset like custom vehicle wraps or have applied ceramic coating for enhanced protection. Assessing whether the benefits justify the investment requires a nuanced perspective. For instance, if your vehicle is relatively new and has a remaining manufacturer’s warranty, extending coverage through a third-party plan might not be as compelling as for an older vehicle with more mileage. Therefore, a balanced evaluation of cost and potential benefits ensures you secure optimal vehicle protection tailored to your unique circumstances.

When comparing warranty protection plans, understanding your product’s specific needs, meticulously reviewing terms and conditions, and evaluating cost against benefits are essential steps. By doing so, you can make an informed decision that ensures optimal coverage for your valuable investment. Remember, the right warranty plan can provide peace of mind and significant savings in the event of unexpected repairs or replacements.